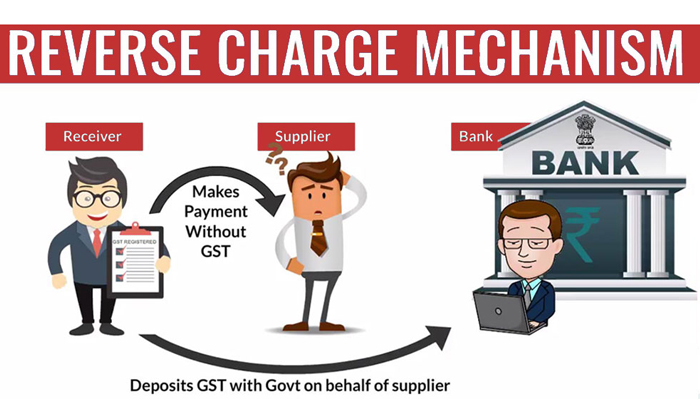

There are two types of GST that apply to everyone. The first is a Forward Charge Mechanism (FCM) or Normal Charge Mechanism in which supplier of goods and supplier of services is responsible for paying tax, and the second is Reverse Charge Mechanism (RCM) in which recipient is accountable for payment of tax. Section 9 of CGST Act, 2017: Levy and Collection includes two major sec of Reverse Charge Mechanism which is Sec 9(3) of CGST Act, 2017 and Sec 9(4) of CGST Act, 2017. According to Section 9(3) of the CGST Act, 2017, the government announced a few particular kinds of supplies of goods and services, or both, on the basis of which the receiver will be required to pay tax based on the reverse charge mechanism. This section depends on nature of supply and /or nature of supplier. The goods specified in the notification are –

| Sr No. | Supply of Goods | Supplier of Goods | Recipient of Goods |

|---|---|---|---|

| 1 | Cashew Nuts which should not be shelled or peeled | Agriculturist | Any registered person |

| 2 | Bidi Leaves (Tendu) | Agriculturist | Any registered person |

| 3 | Tobacco Leaves | Agriculturist | Any registered person |

| 4 | Silk Yarn | Any person who manufacturers silk yarn from raw silk | Any registered person |

| 4A | Raw Cotton | Agriculturist | Any registered person |

| 5 | Supply of lottery | State Government, Union Territory or any local authority | Lottery distributor or selling agent |

| 6 | Used vehicles, seized and confiscated goods, old and used goods, waste and scrap | Central Government, State Government, Union territory or a local authority | Any registered person |

Among the services included in the notice are :

| Sr No. | Supply of Services | Supplier of Services | Recipient of Services |

|---|---|---|---|

| 1 | Taxable services provided by any person who is located in a non-taxable territory and received by any person who is in a taxable territory other than non assessee online recipient | Any person who is in a non-taxable country. | Any person who is located in a taxable country |

| 2 | Services provided by Goods Transport Agency (GTA) in respect of transportation of goods by road. | Goods Transport Agency | a)any registered factory, b)any registered society, c)any corporative society established by any law, d)any person registered under CGST/SGST/UTGST Act, e)any body-corporate, f)any partnership firm whether registered or not under any law, g)casual taxable person |

| 3 | Services provided by an individual advocate or firm of advocates by way of legal services, directly or indirectly | An individual advocates or firm of advocates | Any Business Entity |

| 4 | Services provided by arbitral tribunal | An arbitral tribunal | Any Business Entity |

| 5 | Sponsorship services | Any Person | Any body-corporate or partnership firm |

| 6 | Services provided by government or local authority, excluding -a)renting of immovable property, b)services specified below- i] services given by the Department of Posts in the form of speed post, fast parcel post, life insurance, and agency services to persons other than the government; ii]services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; iii] transport of goods or passengers | Government or Local authority | Any Business Entity |

| 7 | Services provided by a director of a company or a body corporate | A director of a company or a body corporate | A company or a body corporate |

| 8 | Services provided by insurance agent to any person carrying insurance business | Any Insurance agent | Any person carrying on insurance business. |

| 9 | Services provided by a recovery agent to a banking company or a non-banking financial company | A recovery agent | Any Banking company or a financial institution or a non-banking company |

| 10 | Services by way of transportation of goods by ship/boat/vessel from a place outside India up to the customs station of clearance in India. | A person located in non-taxable territory to a person located in non-taxable territory | The customs station of clearance in India. |

| 11 | Transfer or permitting the use or enjoyment of a copyright relating to music, an author, composer, photographer and artistic work | Author or music composer, photographer etc. | Publisher, music company, producer |

| 12 | Radio taxi or passenger transport services provided through E-commerce operator | Taxi driver or a Rent a cab operator | Any person |

| 13 | Supply of services by the members of Overseeing Committee to Reserve Bank of India | Members of overseeing Committee constituted by the RBI | Reserve Bank of India |

According to Sec 9(4) of CGST Act, 2017, on the recommendations of council government has notified a class of registered person in respect of specified categories of goods or services or both received from an unregistered supplier then such registered person shall pay the tax on reverse charge basis as the recipient of such supply of goods or supply of services or both.

Such transactions are always intra-state sales since an unregistered provider is unable to undertake inter-state sales. If you make a total purchase of less than Rs.5,000 from an unregistered individual in a single day, you do not have to pay RCM tax.